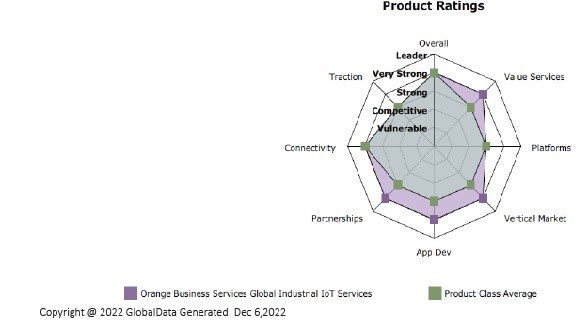

GlobalData ranks Orange Business “Very Strong” for Global Industrial IoT Services

Date: December 2022

Analyst: John MARCUS

According to GlobalData: Orange Business is very strong in the IoT services market, having steadily built the business from basic machine-to-machine (M2M) connectivity to now include end-to-end solutions that span many network types, horizontal and vertical applications, advanced data analytics, and deep professional expertise in support of development, integration, and operation of IoT deployments. Key benefits include its own IoT service delivery and application enablement platforms; widespread network coverage across fixed, cellular, and local access technologies; deep experience in mobile private networks; expertise in security and cloud; and the ability to serve multinational corporations (MNCs) internationally, as well as SMEs and national enterprises locally through Orange operating companies. These strengths give it the flexibility to deliver IoT solutions in a variety of business models, whether connectivity only is required or a business requires an end-to-end solution.

On the connectivity side, Orange is capable of supporting almost any potential network type. Cellular solutions include embedded SIMs (eUICC, available globally and across 18 European countries for business-to-consumer [B2C] services), which have led to large connected car deals, but Orange also provides LPWA support with LoRaWAN, LTE-M, and NB-IoT. In doing so, the provider can offer the right network technology for each use case, rather than leading with a particular network and trying to force solutions to fit the technology. Orange has now launched 5G in France, Romania, Poland, Spain, Luxembourg, and Slovakia, with which it will focus on mobile broadband and critical IoT use cases. It has also extended its LTE-M footprint to almost all of its European mobile network operators, entered into a partnership with SES Networks for satellite IoT connectivity, and expanded its mobile private network portfolio.

Orange recognized early that a vertical approach is necessary to truly deliver solutions that are fit for purpose. It is now targeting three key ‘verticals’ - connected cars and products, smart cities and buildings, and Industry 4.0. In the highly demanding automotive sector, it has found that its strict compliance to eUICC standards has helped it win big in connected car. This was reinforced again in 2021 with its deal supplying integrated SIMs for Lynk & Co, a joint venture (JV) between Geely Auto Group and Volvo. In smart cities (and smart buildings), a strong portfolio of customized and product/service offerings and an ability to meet the stringent IT requirements of public sector jurisdictions have resulted in 100 contracts, both large and small. Orange has put emphasis on energy management and has developed building energy consumption optimization and environmental performance solutions. In Industry 4.0, Orange is finding traction in applications for the mobile workforce, including field personnel, in predictive maintenance, in asset tracking, and in connecting operational technology systems. It also has a partnership with Siemens Digital Industries to target French manufacturers with integrated factory automation systems, comprising of private 5G networks, cybersecurity, and IoT platforms.

Orange reports an installed base of 32.3 million IoT connections (including approximately 15 million automotive devices) across 35 countries, generating revenue from connectivity and services (including consulting for use-case development, application development, and integration).

The expansion of Orange’s value-add in IoT services (beyond connectivity) is, in particular, based on all of the IT capabilities it has acquired, developed, and reinforced over the years in cloud, AI and data analytics, cybersecurity, consulting, and integration areas. The acquisition of Business & Decision, with its expertise in BI and data science, significantly strengthened Orange Business’ operations in data analysis and governance in France and internationally. Orange’s go-to-market is bolstered by complementary capabilities in both security services and support (Orange’s MSI portfolio for services integration has helped it win large IoT deals). Network operator partners are extending its reach and bringing in new customers: for example, with China Telecom’s requirements in Europe or with KDDI, providing access to Japanese customers. Large and small technology vendors are also valuable IoT partners. The recently established IoT Continuum partnerships with Sierra Wireless, STM Microelectronics, and Lacroix are bringing a more coordinated approach to cellular IoT solution building, saving both Orange and its customers time (and costs) on qualifying suppliers and integrating components. This has been validated in a new multi-year contract with tiko to connect 800,000 devices via LTE-M. Partner Siemens is an Industry 4.0 leader, increasingly providing Orange with a powerful co-selling approach that can successfully target enterprises at both the chief information officer and lineof-business levels. Orange has also been successful in B2B2X models in support of vertical/application specialists rolling out digital services (e.g., Octo, for usage-based insurance in Italy).

"It is a great achievement for Orange Business to be rated Very Strong again by GlobalData. This report fully recognizes our expertise as an IoT operator and integrator, giving our customers access to a complete set of IoT building blocks for their projects with global connectivity, certified objects, managed IoT platforms, advanced analytics, consulting and professional services, including cloud and security.

“Our strategic value proposition Smart Industries offers private LTE and 5G networks for industrial campuses in support of industrial IoT use cases, as well as embedded connectivity to OEMs in sectors such as automotive and energy management. Our expertise in IoT helps our clients achieve their own digital transformation projects.”

Valerie Cussac, Vice President Smart Mobility Services, Orange Business

About the analyst: John MARCUS, GlobalData Principal Analyst Enterprise